The month of September saw mixed results from investment markets, with a fair amount of intra-month volatility. The S&P/ASX200 Accumulation Index (XJOAI) returned a 0.5% gain but experienced a sizeable drop of 4% mid-month followed by a recovery over the final two weeks.

Global shares, when measured in Australian dollar terms, went backwards, with the MSCI World Total Return index (AUD) falling by 1.22% during the month. Emerging markets did a little better, with a decline of only 0.53%. Three-month emerging market returns are now topping 6% and we have a good feeling about a change in sentiment towards this sector.

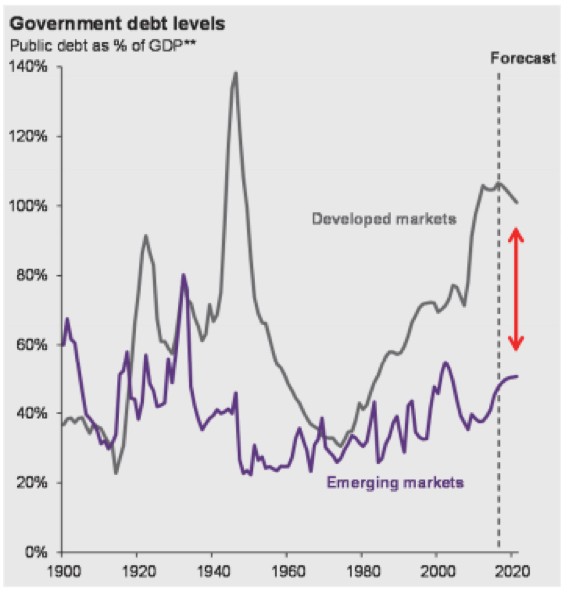

The resource based emerging markets are seeing a stronger recovery, but our preferred exposure is via Asian Emerging Markets, due to their lower correlation to Australia. The average Australian portfolio already has significant exposure to iron ore, coal, and oil, and getting more of that from Brazil is not particularly exciting. However, the fast-growing middle class in Asia, low debt to GDP, and mostly positive demographics give us more confidence in the region, and we express that through our selection of fund managers that have expertise in the region.

Earnings growth in Asian Emerging Markets and lower overall volatility are an attraction. (Fig 1)

Source: J.P. Morgan

While Debt to GDP is more supportive of expansive fiscal policies in Emerging Markets. (Fig 2)

Source: J.P. Morgan

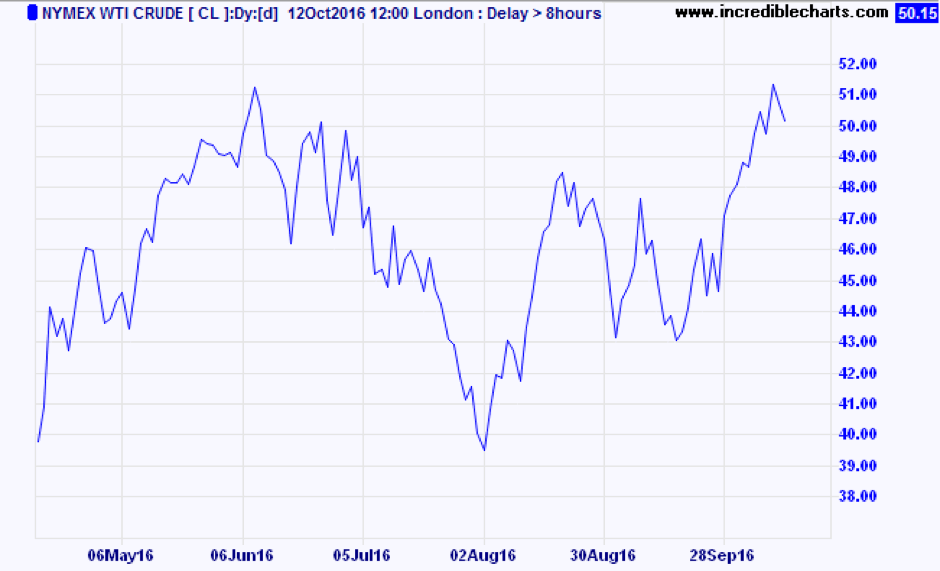

The Australian dollar started the month at $0.7515 and finished at $0.7656 for a gain of 1.8%, reflecting more delay in the US Fed rate-hiking cycle, and an improved market for commodities. Oil is up 27.2% in the last two months.

Crude Oil has led the commodities higher (Fig 3.)

The loser for the month was the Real Estate Trust market (A-REIT’s) with the sector losing 4.31% over the month. Interest rate sensitive stocks have led the rotation lower as money rotates back into commodities and banks. Even with the fall, the A-REIT market is still up 20.88% on this time last year, beating the ASX 200 Accumulation which rose 13.17% for the year to 30 September.

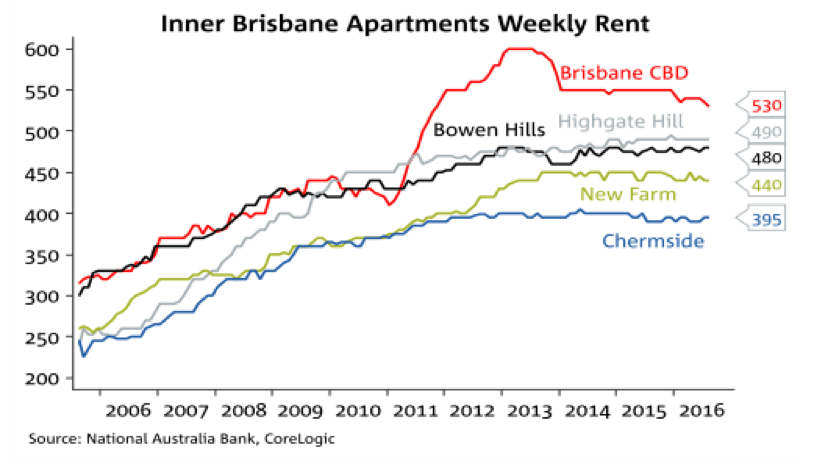

While on the topic of real estate, the following chart from NAB Global Markets showing weekly apartment rents may help give some perspective to why we are cautious on the immediate outlook for apartments.

Aggregate apartment rents flat mostly and falling in the city (Fig 4.)

If you would like more information on the real estate supply demand factors, or any of the points raised in our blog, please get in contact with us.