The 2020-21 Federal Budget is all about jobs, jobs and jobs. COVID-19 has resulted in the most severe global economic crisis since the Great Depression. The 2020-21 Budget provides an additional $98 billion of response and recovery support under the COVID-19 Response Package and the JobMaker Plan.

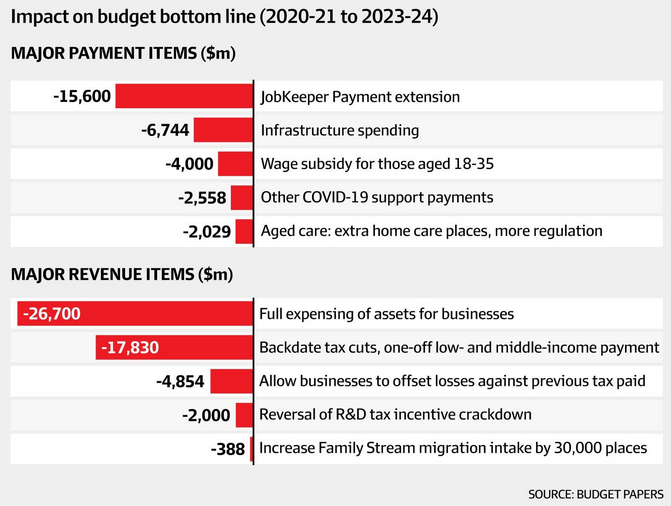

The single biggest measure in the budget is designed to turbocharge business investment by allowing almost every company in Australia to immediately write off in full any eligible depreciable asset. The measure, which has no limit in value, is forecast to cost $26.7 billion over four years.

Other big measures in the budget include backdating income tax cuts (at a cost of $17.8 billion over the next four years) and the extension of the JobKeeper Payment scheme (at a cost of $15.6 billion).

Article Contents

Personal income tax cuts 2020-21

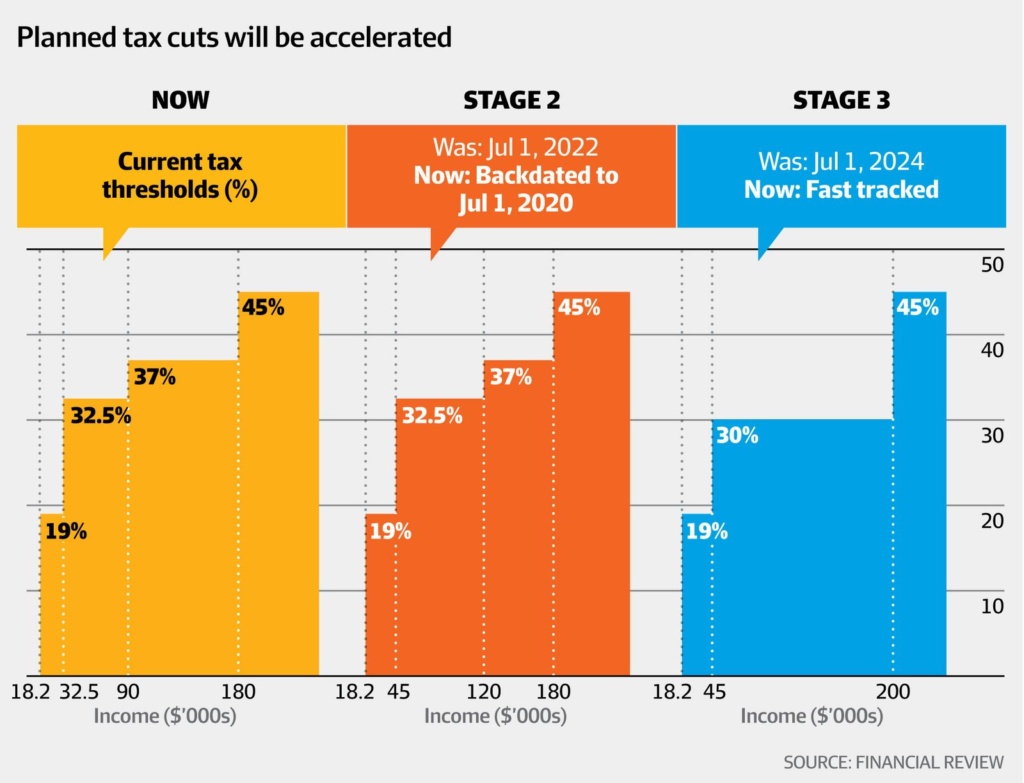

In the 2020-212 Budget the Government will lower taxes for individuals by bringing forward its ‘stage two’ tax cuts that were due to start in July 2022.

This means from 1 July 2020, the 32.5% tax rate will apply to incomes up to $120,000 (previously $90,000). The ‘stage three’tax cuts will continue on its legislated timeline of 1 July 2024 which will repeal the 37% tax rate and impart a 30%tax rate for all individuals earning between $45,000 and $200,000.

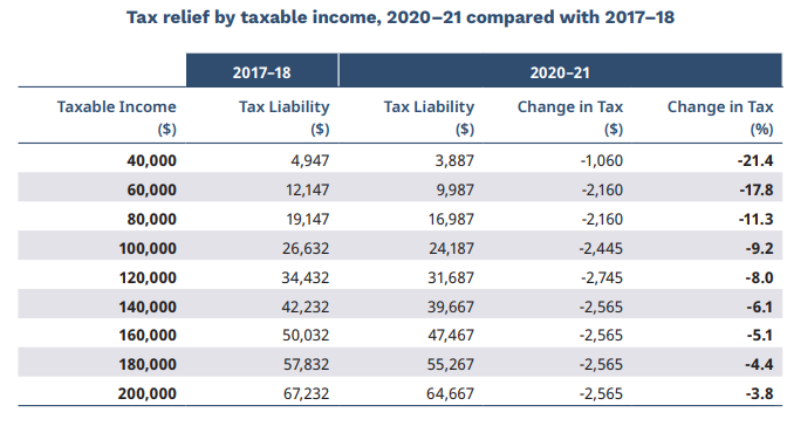

In 2020–21, low–and middle–income earners will receive tax relief of up to $2,745 for singles, and up to $5,490 for dual income families, compared with 2017–18 settings.

Temporary full expensing of eligible capital assets

The Government will support businesses with aggregated annual turnover of less than $5 billion by enabling them to deduct the full cost of eligible capital assets acquired from 7:30pm AEDT on 6 October 2020 (Budget 2020-21 night) and first used or installed by 30 June 2022.

Full expensing in the year of first use will apply to new depreciable assets and the cost of improvements to existing eligible assets. For small and medium sized businesses (with aggregated annual turnover of less than $50 million), full expensing also applies to second-hand assets.

Businesses with aggregated annual turnover between $50 million and $500 million can still deduct the full cost of eligible second-hand assets costing less than $150,000 that are purchased by 31 December 2020 under the enhanced instant asset write-off. Businesses that hold assets eligible for the enhanced $150,000 instant asset write-off will have an extra six months, until 30 June 2021, to first use or install those assets.

Small businesses (with aggregated annual turnover of less than $10 million) can deduct the balance of their simplified depreciation pool at the end of the income year while full expensing applies. The provisions which prevent small businesses from re-entering the simplified depreciation regime for five years if they opt-out will continue to be suspended.

In-house software development

If you’re wondering whether this 2020-21 Budget measure also covers in-house software development costs, than the answer is yes.

The definition of in-house software contained in Section 40 of the Tax Act is broad and includes the right to use computer software or software that is acquired from third parties. More on in-house software development costs can be found on the ATO website here: In-house software.

Temporary loss carry-back to support cash flow

The 2020-21 Budget announced that eligible companies will be allowed to to carry back tax losses from the 2019-20, 2020-21 or 2021-22 income years to offset previously taxed profits in 2018-19 or later income years.

Corporate tax entities with an aggregated turnover of less than $5 billion can apply tax losses against taxed profits in a previous year, generating a refundable tax offset in the year in which the loss is made. The tax refund would be limited by requiring that the amount carried back is not more than the earlier taxed profits and that the carry back does not generate a franking account deficit. The tax refund will be available on election by eligible businesses when they lodge their 2020-21 and 2021-22 tax returns.

Currently, companies are required to carry losses forward to offset profits in future years. Companies that do not elect to carry back losses under this measure can still carry losses forward as normal.

Importantly, the loss carry-back measure and full expensing measure work together. For example if your business purchases and fully expenses an eligible asset in the 2020-21 financial year, and the deduction from that purchase (or purchases) creates a tax loss, this loss can be used to generate a refund of prior year company tax paid when your 2020-21 return is lodged.

Increase the small business entity turnover threshold

The Government will expand access to a range of small business tax concessions by increasing the small business entity turnover threshold for these concessions from $10 million to $50 million.

We cover this change in more detail in our article: Small Business Tax Concessions Expanded

JobMaker Hiring Credit

The Government will provide $4.0 billion over three years from 2020-21 to accelerate employment growth by supporting organisations to take on additional employees through a hiring credit. The JobMaker Hiring Credit will be available to eligible employers over 12 months from 7 October 2020 for each additional new job they create for an eligible employee.

Eligible employers who can demonstrate that the new employee will increase overall employee headcount and payroll will receive $200 per week if they hire an eligible employee aged 16 to 29 years or $100 per week if they hire an eligible employee aged 30 to 35 years. The JobMaker Hiring Credit will be available for up to 12 months from the date of employment of the eligible employee with a maximum amount of $10,400 per additional new position created.

To be eligible, the employee will need to have worked for a minimum of 20 hours per week, averaged over a quarter, and received the JobSeeker Payment, Youth Allowance (other) or Parenting Payment for at least one month out of the three months prior to when they are hired.

The 2020-21 Budget JobMaker factsheet can be downloaded here: JobMaker Hiring Credit

Research and Development Tax Incentive

The 2020-21 Budget has announced further enhancements to the 2019-20 MYEFO measure Better targeting the research and development tax incentive — refinements to support business Research and Development (R&D) investment in Australia and help businesses manage the economic impacts of the COVID-19 pandemic.

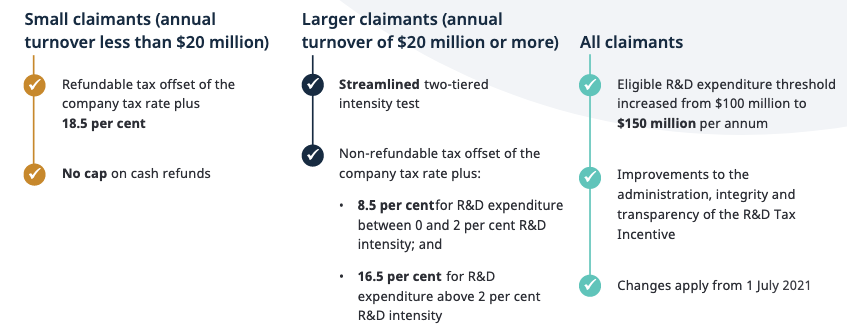

For small companies, those with aggregated annual turnover of less than $20 million, the refundable R&D tax offset is being set at 18.5 percentage points above the claimant’s company tax rate, and the $4 million cap on annual cash refunds will not proceed.

For larger companies, those with aggregated annual turnover of $20 million or more, the Government will reduce the number of intensity tiers from three to two.

The R&D premium ties the rates of the non-refundable R&D tax offset to a company’s incremental R&D intensity, which is R&D expenditure as a proportion of total expenses for the year. The marginal R&D premium will be the claimant’s company tax rate plus:

- 8.5 percentage points above the claimant’s company tax rate for R&D expenditure between 0 per cent and 2 per cent R&D intensity for larger companies

- 16.5 percentage points above the claimant’s company tax rate for R&D expenditure above 2 per cent R&D intensity for larger companies.

The Government will defer the start date so that all changes to the program apply to income years starting on or after 1 July 2021.

Fringe Benefits Tax Changes Budget 2020-21

Exemption to support retraining and reskilling

The Government will introduce an exemption from the 47 per cent fringe benefits tax (FBT) for employer provided retraining and reskilling benefits provided to redundant, or soon to be redundant employees where the benefits may not be related to their current employment. This measure applies from announcement.

Reducing the compliance burden of record keeping

The Government will provide the Commissioner of Taxation with the power to allow employers to rely on existing corporate records, rather than employee declarations and other prescribed records, to finalise their fringe benefits tax (FBT) returns. The measure will have effect from the start of the first FBT year (1 April) after the date of Royal Assent of the enabling legislation.

CGT exemption for granny flats

The Government will provide a targeted capital gains tax – CGT exemption for granny flat arrangements where there is a formal written agreement. The exemption will apply to arrangements with older Australians or those with a disability. The measure will have effect from the first income year after the date of Royal Assent of the enabling legislation.

CGT consequences are currently an impediment to the creation of formal and legally enforceable granny flat arrangements. When faced with a potentially significant CGT liability, families often opt for informal arrangements, which can lead to financial abuse and exploitation in the event that the family relationship breaks down. This measure will remove the CGT impediments, reducing the risk of abuse to vulnerable Australians.

For more information on this measure, read out article: CGT exemption for granny flats

Stapled super accounts

In a welcome change that will reduce the number of people with duplicate superannuation accounts, the Government has announced that from 1 July 2021 an employees super account will be ‘stapled’ to them when they change jobs.

In addition a YourSuper comparison tool will be developed to enable easy comparison of superannuation funds based on fees and performance and poor performing funds will have to notify members of their poor performance.

More on this measure can be found in the following article: Stapled super accounts to become default

Summary of 2020-21 Budget measures

In a welcome change that will reduce the number of people with duplicate superannuation accounts, the Government has announced that from 1 July 2021 an employees super account will be ‘stapled’ to them when they change jobs.

In addition a YourSuper comparison tool will be developed to enable easy comparison of superannuation funds based on fees and performance and poor performing funds will have to notify members of their poor performance.

More on this measure can be found in the following article: Stapled super accounts to become default

The 2020-21 Budget is very much a business friendly budget designed to encourage business confidence and investment to create jobs. A budget deficient of $213.7 billion or 11% of GDP is expected this financial year and total Government debt will exceed $1 trillion dollars. Fortunately for the Government the cost of servicing this debt is at historically low levels.

If you have any questions or would like further information on any of these measures and how they may benefit you or your business, please get in touch.