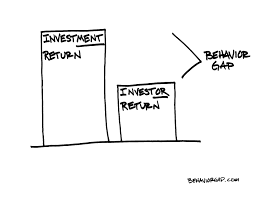

Dalbar the respected United States Boston-based consulting firm has recently released its famous Qualitative Analysis of Investor Behaviour (QAIB) study, now in its 21st annual edition. It once again exposes a wide gap between investments returns – the return of a benchmark index – and the much smaller returns that investors actually captured. In the United States, the S&P 500 index returned an average of 9.85% per year compared with the 5.19% average annual return of stock fund investors, through the 20 years ending December 31, 2014.

So why the Gap?

Dalbar has always pinned the performance gap to poor investor behaviour, eg. selling in panic and buying amid the elevated prices accompanying investor euphoria. Put simply, the approximately 4.5% was lost due to bad timing of transactions by the average US investor. Bad timing of transactions generally driven by decisions based on EMOTION. The emotions of FEAR OR GREED. This is truly wealth destroying behaviour!! So if investing success is about BEHAVIOUR and not skill, then what does that mean to you?

It means that emotion plays a huge role in the financial decisions you make. EMOTION is so important, it can determine your success or failure as an investor.

The good news is that unlike the MARKET, your BEHAVIOUR is something you can control!!