There are over 16 million credit cards in Australia, netting a national debt accruing interest of around $32.5 billion. Most of us have them. Most of us use them. Personal finance experts – spend a lot of energy trying to prevent us from using them – and with good reason. Many of us abuse them and end up in debt we may not be equipped to handle. After all, it is easy to lose track of spendings if you are not careful. But, when is the panic button pushed? When do we start to think “Oh, I better slow down” or “Eeek, I need to start paying more off my credit card”.

Well, a recent finder.com.au poll of more than 2000 people has found that the panic button scenario only creeps in when we rack up $4113 in debt.

Some more interesting stats from the survey:

- According to the finder.com.au June 2016 survey, 70.19% of Australian adults own a credit card

- The average credit card balance is just under $3150

- The average purchase on credit cards is $120.97

- People born between the mid-1960s and 70s are the most comfortable with credit card debt, saying $4357 was their tipping point

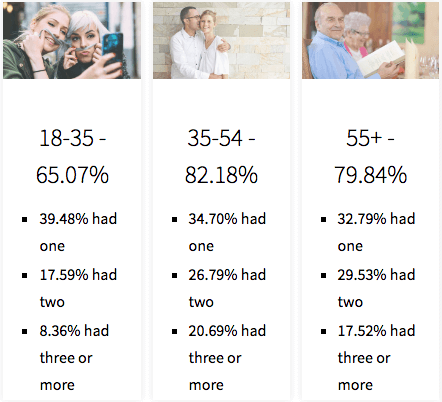

Demographics

How many Australians own credit cards by age group?