Australian shares rallied again in June, capping a better than average year. The recovery from the sell-off in the fourth quarter of 2018 was spectacular. We got a capital gain of 21% in the period from the December 21 lows, plus a sack full of dividends from companies distributing franking credits ahead of the Labor proposal to end refunds.

Global shares also did well, slightly pipping the Australian shares over 12 months with an 11.94% total return.

Adding fuel to the share market return was an about face by the US Federal Reserve, which was threatening tighter rates for most of 2018, followed by what is termed a ‘dovish pivot’ in early January (for non Fed-watchers, the Federal Reserve is said to be ‘dovish’ when rates are being lowered, and ‘hawkish’ when rates are rising. It can also refer to the general mood or bias of the majority of members of the board).

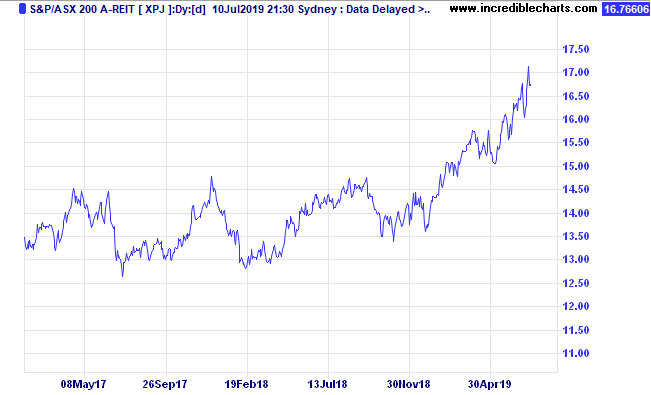

The biggest winner out of the Federal Reserve and the Australian RBA easing bias was the Australian Real-Estate Investment Trust market, also referred to as A-REIT’s. These had a total return of 19.32% during the 2019 financial year.

| INDEX RETURNS AS AT 30 June 2019 (%) | ||||

| 1 month | 3 months | 6 months | One year | |

| Australian Shares | 3.70 | 7.97 | 19.73 | 11.55 |

| International Shares | 5.27 | 5.00 | 16.91 | 11.94 |

| Australian Listed Property | 4.22 | 4.07 | 19.42 | 19.32 |

| Global Listed Property | 0.48 | -0.06 | 13.99 | 7.70 |

| Australian Fixed Interest | 1.04 | 3.05 | 6.59 | 9.57 |

| International Fixed Int | 1.29 | 2.68 | 5.55 | 7.32 |

| Cash | 0.13 | 0.45 | 0.97 | 1.97 |

| Market Indices | ||||

| S&P/ASX 200 Accumulation Index | ||||

| MSCI AC World ex Aust TR Index $A | ||||

| S&P/ASX 300 Property Trusts Accum Index | ||||

| FTSE EPRA/NAREIT DEVELOP NR INDEX (A$ HEDGED) | ||||

| Bloomberg Composite 0 + Years | ||||

| BarCap Global Aggregate Index Hedged AUD | ||||

| Bloomberg Aus Bank Bill Index | ||||

You could be forgiven for saying ‘that A-REIT return looks different from the ‘property price’ returns that I’ve been seeing’! That is because the residential housing market is quite different from the market for large trusts that own commercial, industrial and retail property.

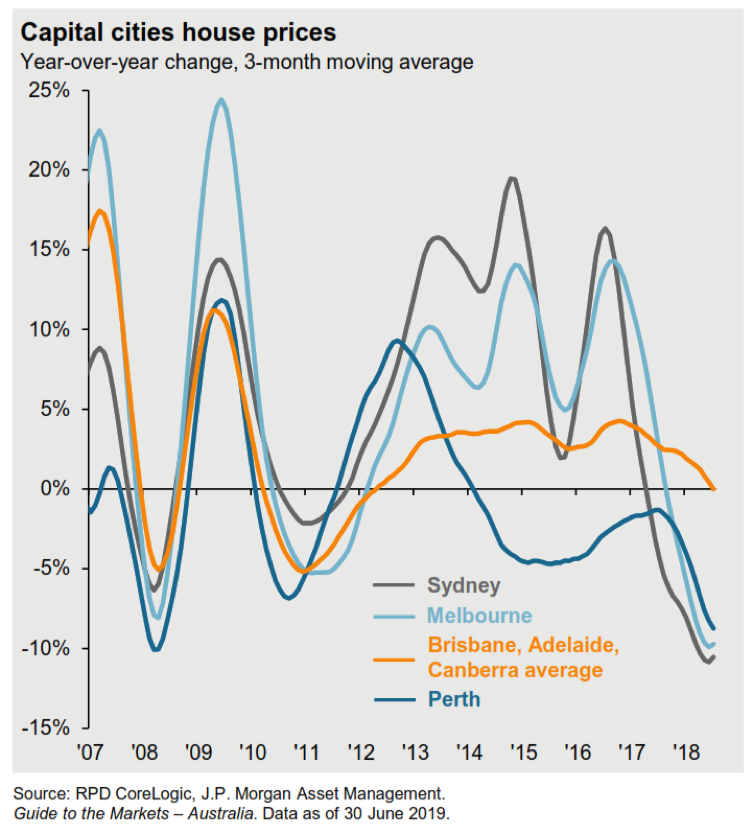

In Chart 1, we show the rate of change in capital city housing prices.

Chart 1: Source, JP Morgan

Next, we have a chart of the capital gains of A-REIT’s over the last two years.

Chart 2: Source, Incredible Charts

The A-REITs were already anticipating higher interest rates in 2016 and had a 17% sell-off between August 2016 and early February 2018. Since then, this interest rate sensitive sector has been a spectacular performer as markets have come to a new realisation that interest rates are not going up any time soon, and the attraction of passive commercial rents (that have been rising, thanks to supply shortages) grows ever stronger.

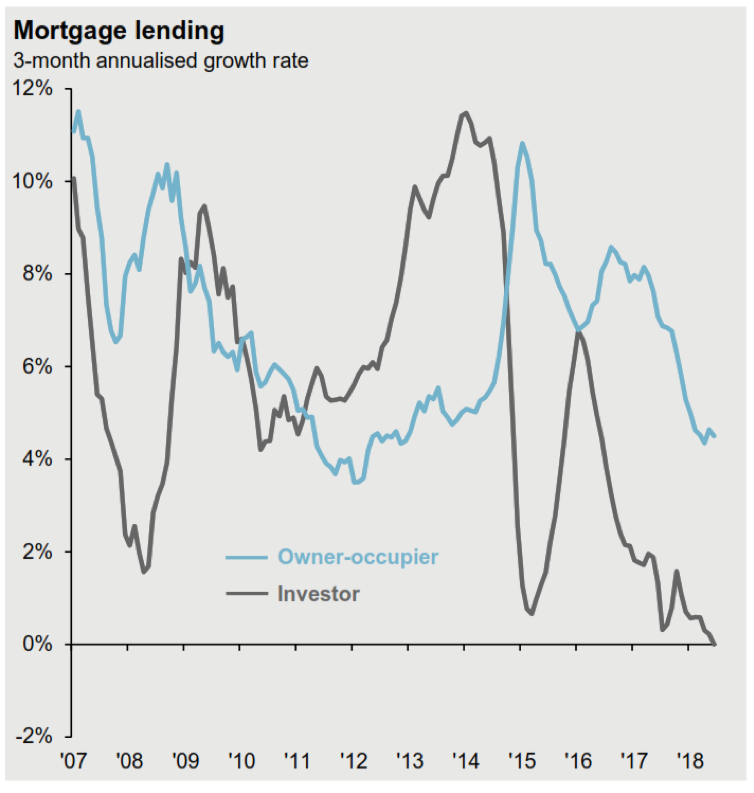

Residential property on the other hand is far more subject to the supply of new capital to push prices higher. There is not a lot of institutional money invested into residential property (unlike A-REIT’s which are now being driven strongly by passive flows into Exchange Traded Funds), rather, the real driver is credit creation.

Chart 3: Source, JP Morgan, ABS

You can see in Chart 3 above, that this current credit contraction is deeper than even the GFC when investor lending only fell to slightly under 2% growth rate year on year. We are now sitting at 0% growth in investor lending.

If you are wondering how much effect lending growth rates have on house prices, Chart 4 has the story.

Chart 4: Source, JP Morgan, ABS, RPD Core Logic

Without growth in lending, house prices will stagnate at best. So, to get a handle on where residential house prices are going, watch the housing finance commitments closely.

This is not a signal to rush into the A-REIT market. In fact, there we see signs of froth and bubbles, and need to be cautious. Developers and companies that have been reaping performance fees now dominate the index, and those profits may not be sustainable if this slowdown in global economies is made worse by the current trade tensions.

Receive peace of mind in your personal finance – call Quill Group today

If you want to get more involved with your superannuation, investments or insurance, please give us a call at Quill Group.