Some time ago, my daughter was lamenting that she didn’t have enough money to pay her phone bill and the rest of her bills. I suggested she should create a budget in excel. Her reply was ‘How can I create a budget when I don’t have enough money?’.

Now at 23, and living interstate, she asked me how to create a budget in excel so she can save for all the things she wants to do, and still be able to pay her bills. I must say, living by themselves and paying their own way changes a child’s attitude. While staying with her on a recent trip, I was chastised for leaving the bathroom light on! Yet only a few years ago I remember continually turning off lights and fans well after the room was vacated. How the tables turn.

1. Look at and categorise your expenses

The first step to creating a budget is to look at your expenses. You can use your receipts, or use a budgeting app. If you’re with Macquarie or Commonwealth Bank, they have excellent avenues to track your spending via their apps. An excel spread sheet can also help – you can write down where and what the expense was, and the amount. This starts to build a picture of where your money goes.

To take it to the next level, you can separate these expenses into 2 basic categories – ‘needs’ and ‘wants’. Make sure you put the take-aways and dining out in the ‘wants’ category. These I classify as reward items.

Now you have a clearer picture of where your money goes, let’s start on the budget. You can download various budget tools, but I find they tend to work on monthly and annual amounts. I’ve created my own excel spread sheet which I update each week.

Nominate a regular time to go through your past week’s expenses and bills due to be paid in the coming week.

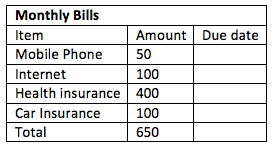

2. What are your regular/monthly bills?

Look at your monthly bills and list them out. Such as:

Add all those other little things (‘wants’) like Spotify, Netflix, etc.

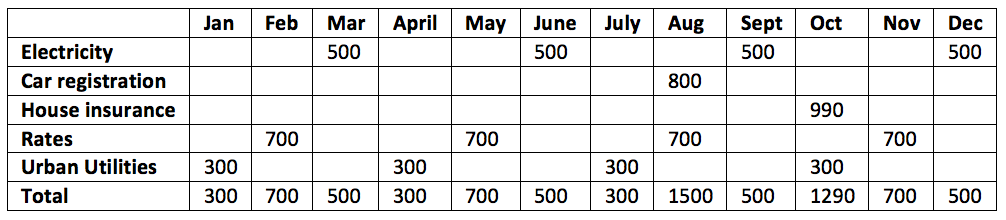

3. Other bills

What are your other bills and when are they due? Look at what you pay during the year. Such as:

So, you need 12 times your monthly expenses plus your annual and quarterly bills. In this example we have a total of $15,590 minimum per annum to pay the bills each year. Divide this total by the number of pay days in the year. For example, fortnightly, $15,590/26 = 599.61. In this instance, you need to set aside at least $600 per fortnight to pay your bills.

Put this amount in a separate account. I call mine ‘bill’ and put in place an automatic direct debit for the day after payday. You can set up direct debits for bill payments from this account. Direct debits for bill payments ensures the bill is paid on time and you don’t end up paying late fees. Also, some companies give you a discount for direct debits.

Whenever you receive a bill, update this spread sheet and adjust the amount you need to put aside.

Now that the bills are paid, let’s look at your other expenses.

4. Other expenses

You should now have an idea what you are spending each week. If you are wanting to save or increase mortgage repayments, this is the area you need to review.

Your expenses should be trimmed to essential items, plus an extra amount for those unforeseen expenses or treats (‘wants’), such as lunch with friends. You should then be able to formulate how much you can save.

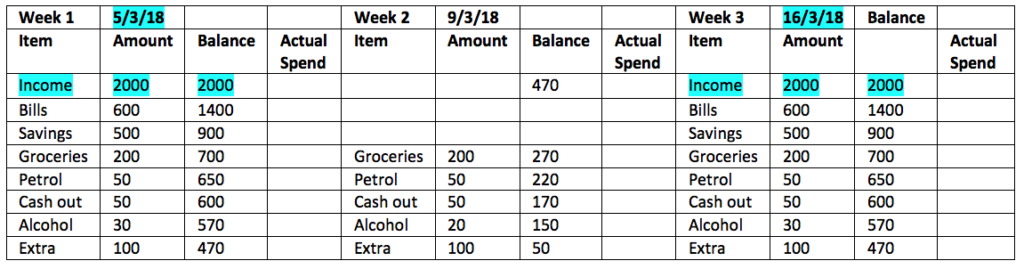

Start a new tab in your spreadsheet. The table below is broken up into weeks in the month with paydays highlighted.

You can update your spreadsheet each week with the amount you actually spend, to compare to your budgeted amount. This will determine if you need to make further adjustments.

5. Set goals and stick to it

Once you have set your saving goals, the most important thing is to stick to your budget!

When you start out, it can take a little time to form new spending habits. You will need to review and monitor your expenses until you are comfortable with your budget. You will also need to monitor your bills account especially in the beginning when funds are building. You may have to fund some bills from your weekly expenditure instead of the bill account if there are insufficient funds.

Remember to reward yourself now and then. If you want, you can add another account and deposit a few dollars each week.

Speak to your adviser

If you have any questions, or would like to talk to anyone, we would be more than happy to talk to you about your financial goals. You can make an appointment with our Eight Mile Plains or our Southport office, or get in contact via our website.