In this month’s market update, our role as financial advisors, almost daily we are asked questions regarding the current trends within investment markets. Lately we have seen many ‘get rich quick’ schemes off the back of the current hype around crypto currencies and other “sexy” stocks like GameStop that gained much attention off the back of forums like Reddit/WallStreetBets.

Investors are also getting bombarded with more information around investing than ever before. However, you would be aware that we have tried to maintain a more traditional approach to investing and avoid the short term hype, as we still firmly believe in the basic principles of investment that have been around for many years and stood the test of time.

Essentially, we believe that any investible asset must ultimately provide a fundamental economic return – usually in the form of earnings, interest or rent – to be justified and sustained.

I recently read an article by Shane Oliver, AMPs Chief Economist, where he listed some valuable quotes and insights into investing. I thought that now might be an opportune time to share these with our readers.

Investing

“The four most dangerous words in investing are: ‘this time it’s different’.” – John Templeton

This is a good one because I hear versions of “this time it’s different” over and over. History tells us that that there are good times and bad and assuming that either will persist indefinitely is a big mistake. Whenever you hear talk of “new paradigms”, “new eras” or “new normals” it’s usually getting time for the cycle to go in the other direction. But the same applies to claims that there is a new way to invest and make millions. Maybe if you get in early and it then sucks in the crowd you could do well. But that’s more luck.

“Investing should be like watching paint dry or watching grass grow. If you want excitement…go to Las Vegas.” – Paul Samuelson

Investing is not the same as gambling or gaming and, while it should be rewarding and enjoyable, it’s not really entertainment. It requires a much longer time frame to payoff consistently.

“There is no free lunch.” – Anon

If an investment looks too good to be true or sustained in terms of return or risk, it probably is. Rather, focus on investments offering sustainable cash flows (dividends, rents, interest) that don’t rely on excessive gearing or financial engineering.

“Never invest in a business you can’t understand.” – Warren Buffett

Many lost a fortune through the GFC in investments that were not easy to understand and involved excessive complexity. While there’s likely something in blockchain and digital finance, the same caution applies to crypto currencies.

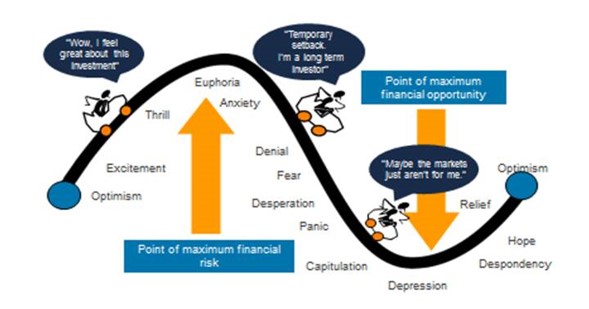

“Bull markets are born on pessimism, grow on scepticism, mature on optimism and die of euphoria.” – John Templeton

This is perhaps one of the best characterisations of how an investment cycle unfolds. It follows that the point of maximum opportunity is around the time most are pessimistic and bearish (as this is often when the market is cheapest) and the point of maximum risk is when all are euphoric (this is often when the market is most expensive), but unfortunately many don’t realise this because it involves going against the crowd. So, in trying to assess whether we are at the bottom or the peak of a cycle it’s worth considering whether we are seeing pessimism and depression for bottoms and euphoria for tops.

The roller coaster of investor emotion

“History doesn’t repeat but it rhymes.” – Often attributed to Mark Twain (although it’s unclear he actually said it)

No two cycles are the same. For example, the bear market associated with the GFC had a radically different genesis to the pandemic-driven bear market last year. But each cycle has common elements which make them rhyme. In upswings, investment markets are pushed to the point where the relevant asset has become overvalued, over loved (in that everyone is on board) and over bought and vice versa in downturns. Recognising these common elements is necessary if you are to get a handle on cyclical swings in investment markets.

Timing Corrections

“More money has been lost trying to anticipate and protect from corrections than actually in them.” – Peter Lynch

Preserving capital is important, but this can be taken too far and often is in the aftermath of bad times with the result that investors end up so focused on trying to avoid losses in shares they miss the returns they offer. We have seen a bit of that ever since share markets bottomed in March 2020, with numerous forecasts for steep falls ever since and yet markets have fallen a few percent every so often only to resume their rising trend.

Pessimism (and the pandemic)

“To be an investor you must be a believer in a better tomorrow.” – Benjamin Graham

If you don’t believe the bank will look after your term deposits, that most borrowers will pay back their debts, that most companies will see rising profits over time as the economy grows, that properties will earn rents, etc (and that the world will learn to shake off or live relatively safely with coronavirus) then there is no point investing. This is flippant but true – to be a successful investor you need a favourable view of the future.

Growing wealth & long-term investing

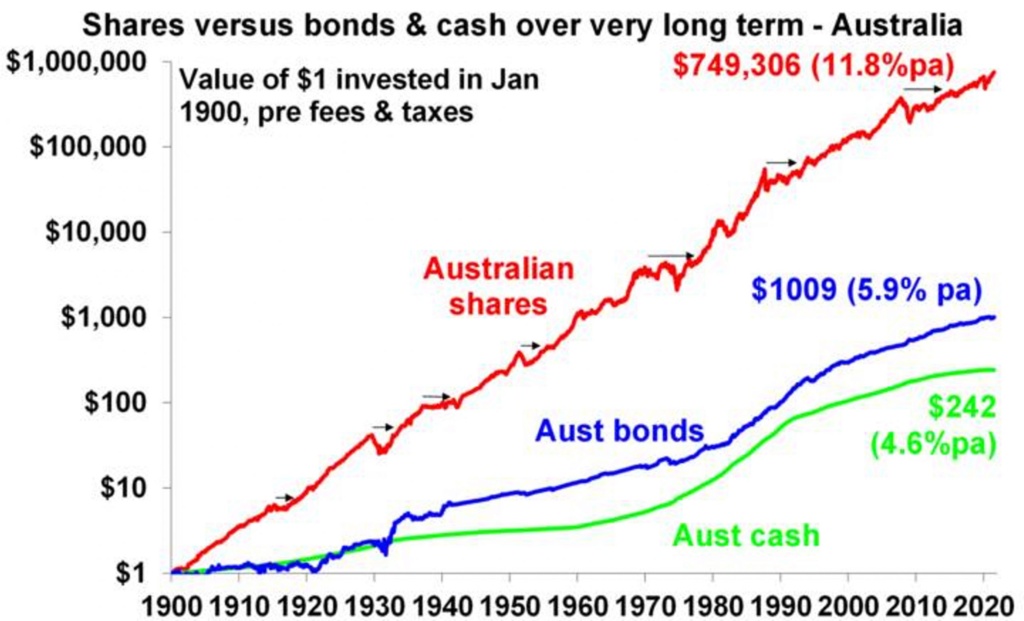

“Put time on your side. Start saving early and save regularly. Live modestly and don’t touch the money that’s been set aside.” – Burton G Malkiel

For an investor, time is your friend and the earlier you start the better. This along, with having exposure to growth assets, is the best way to take advantage of the magic of compound interest. Fortunately, the Australian superannuation system is based on just that. The next chart shows the value of $1 invested in various Australian asset classes since 1900 allowing for the reinvestment of any income along the way. That $1 would have grown to $246 if invested in cash, $1009 in bonds but $749,306 if invested in shares. While the average share return is only double that in bonds, the huge gap in the end result owes to the magic of compounding returns on top of returns. A growth asset like property is similar to shares over long periods in this regard. Short-term share returns bounce around and can go through lengthy bear markets (shown with arrows on the chart). But the longer the period you allow to build your savings, the easier it is to look through short-term market fluctuations, and the greater the time the compounding of higher returns from growth assets has to build on itself.

Source: ASX, Bloomberg, AMP Capital

“Much success can be attributed to inactivity. Most investors cannot resist the temptation to constantly buy and sell.” – Warren Buffett

Unless you really want to put a lot of time into trading, it’s advisable to only invest in assets you would be comfortable holding for the long term. This is less risky than constantly tinkering in response to predictions of short-term changes in value and all the noise around investment markets.

“Don’t look for the needle in the haystack, just buy the haystack!” – John C Bogle

Trying to beat the market by stock picking can be hard and so if you want to consistently grow wealth the key is to get a broad exposure to the market and let compound interest do its job.