Now is a great time to reflect on how our emotions can sabotage our long term investment goals.

We have just witnessed the fastest bear and bull market flip flop in history. The events that have unfolded so far in 2020, in such a compressed time frame, provides a good opportunity to reflect on the emotional roller-coaster and see what beneficial lessons are there to be learned.

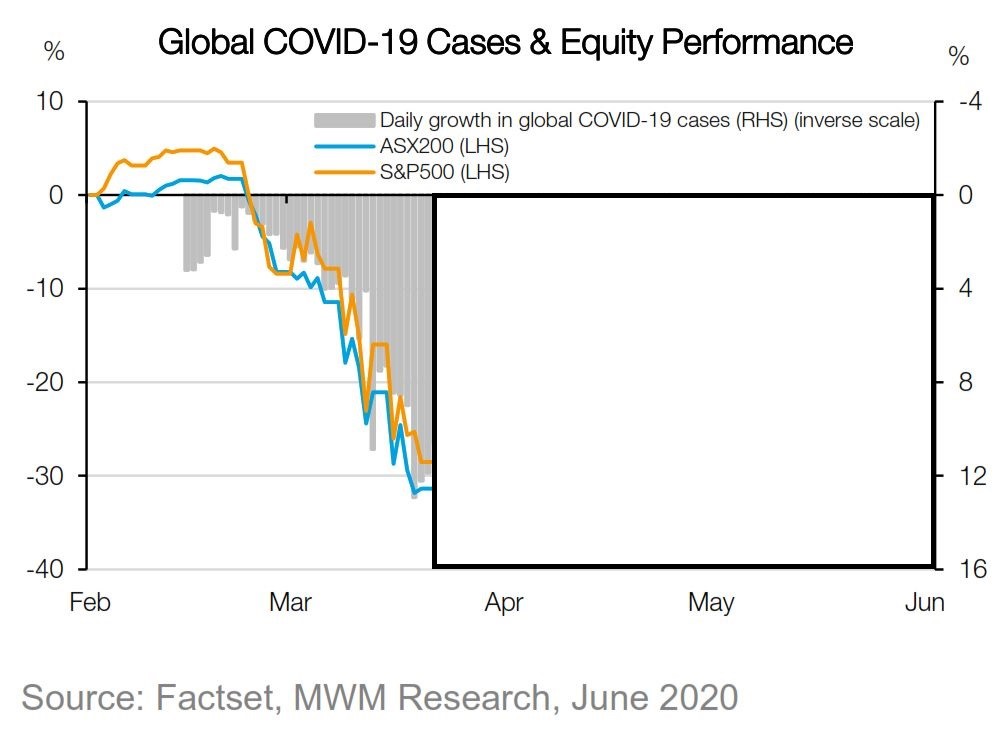

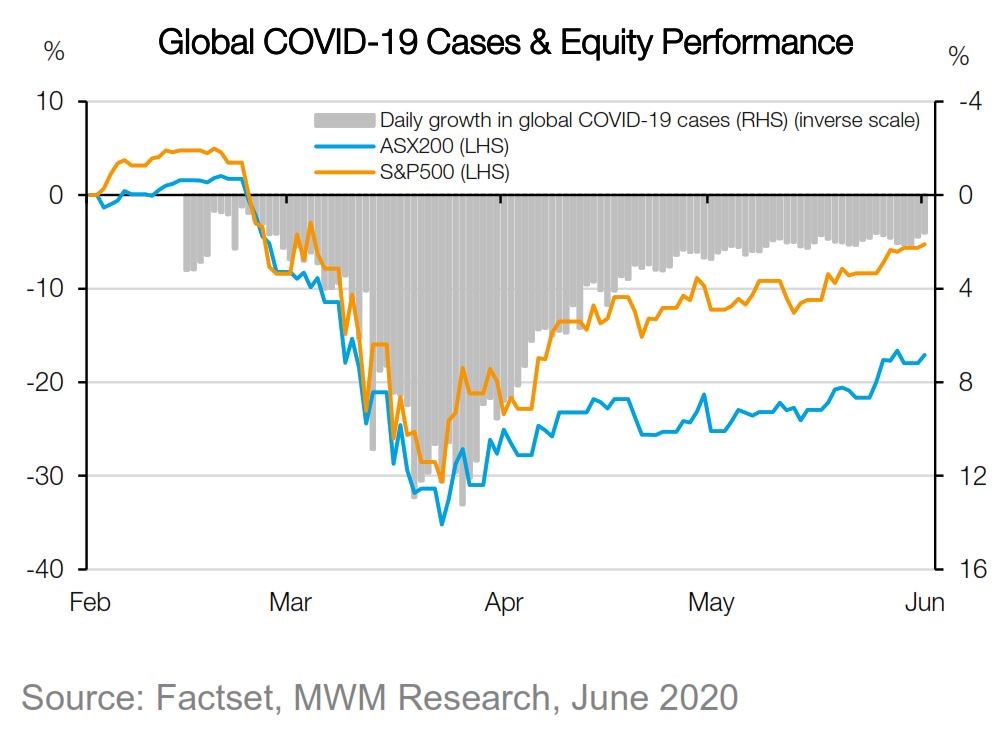

A common error that we can easily make is to extrapolate a trend. Consider for example the chart below where we show the daily growth rate in COVID-19 cases, overlayed with the Australian and US stock index rate of change.

We have purposely covered the right hand side of the chart as a reminder that each day we are making decisions without the benefit of knowing with any great scientific accuracy what happens tomorrow. Often these moments are likely to have a big impact on your financial future.

What were your thoughts as we went through this? Was it to sell everything on the first 5% fall? With hindsight that would have been a great call. You may even have then been proud of your decision by late March. However every year the share market generally has a peak to trough decline of around 10%, and then gets on with normal business again. This could have been one of those events. Or, maybe you were thinking of selling just before anyone of those spikes upward during March, as the month had massive up-days as well as down days. We tend in hindsight to forget those up-days because we now know the eventual outcome which so far has been OK for a buy and hold investor.

Once we see the full picture of a major financial event, our version of what we would have, could have, should have done along the path can undergo a change. As humans we are all susceptible to selective memory and many biases. And we all have many different personality types that trick us in different ways. Some of our beat ourselves up for lack of foresight. Others beat up on their money managers who should have had better foresight. Others assume the game is rigged in favour of the ‘big guys’.

The fact is that an important element of being successful in the investment world is to realise that we don’t know what happens in the next five minutes, five days, five weeks.

Smart investors know that. Charlie Munger, Warren Buffett’s partner in Berkshire Hathaway, said;

If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century you’re not fit to be a common shareholder, and you deserve the mediocre result you’re going to get compared to the people who do have the temperament, who can be more philosophical about these market fluctuations.”

That is the reality of investing. That is also why we never go all in on one investment thesis. We diversify into different markets, industries and investment types. We try to align investment holdings with the time frames that are appropriate to that asset class. There is a lot of psychology, as well as art that accompanies the science of successful investing. Knowing oneself, the biases, foibles and limitations we all have, is an important part of being a successful investor.