This week’s economic note note is again dominated by the increased cost of lock-downs. The cost of Victoria’s increased lock-down is estimated to be a hit of $12bn to the National economy. The Federal budget deficit is now projected at $235bn up from the most recent projection of $184bn. These are very large numbers and I doubt anyone would be surprised if this number increased over the next quarter.

Increased Debt Levels

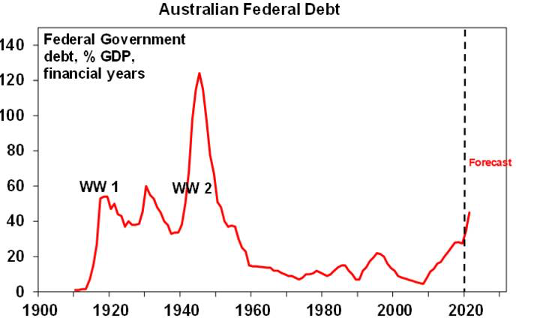

However, as previously stated this should be viewed in the context of a percentage of GDP. The graph below shows the latest forecast at somewhere between 40% and 50% of GDP and history over the last 100 years shows that this percentage has been a lot higher, albeit during times of war.

Source: RBA, Australian Treasury, AMP Capital

The other thing to remember is that many of our trading partners would love to be in a similar position as many have debt levels that are significantly higher. Of course this still poses enormous pressure and challenges on future Governments to come up with policies that drive employment and create higher levels of growth. Additional stimulus is therefore very likely to come in the form of investment incentives, tax cuts or a combination of both.

Interest Rates on Hold

In other news, the RBA left monetary policy (interest rates) on hold this week at 0.25% but did leave the door open to further cuts should things deteriorate more. Most economists are now predicting any rate hikes to be at least 3 years away.

Share Market Rebound

One of the questions that many people are asking is why have share markets rebounded so quickly despite the pandemic in many countries actually getting worse.

There has been some positive news regarding various COVID-19 treatments and potentially even an eventual vaccine, but a vaccine realistically is some way off. However, things could certainly continue to get worse with the pandemic before they get better and coupled with that we have a US Presidential Election due in November which further adds to the short term risk.

Why then are we continuing to see periods of strong share market performance?

One could argue that at present there are not many alternatives for investors seeking above inflation level returns but the most likely scenario is the huge amount of stimulus pumped into the global economy over recent months coupled with very low interest rates making some shares look reasonable value at these current levels.

A good example of this is listed infrastructure assets, many of which have been impacted in the short term by the various lock-downs but are now trading significantly below what some managers believe is fair value.

All seasoned investors understand that predicting next weeks or next months movements is near enough to impossible, so instead we have to focus on what will likely happen over the next three years. This is how our investment managers position themselves, and we encourage our investors to also look at portfolios with the same mindset.

If you have any questions regarding any of the information contained in this article, please get in touch with your Quill Relationship Manager.