When to lodge your Business Activity Statement

When is BAS due? Knowing the key dates for lodgement is important to make sure you pay on time and avoid late lodgement penalties or general interest charges for overdue amounts. To avoid penalties, find out when BAS is due, and refer to the information found on ‘Failure to lodge on time penalty’ by the Australian Taxation Office for more. In addition to this, you can also read more about what to do if you’re lodging your BAS statement late.

There are 2 types of Activity Statements – an Instalment Activity Statement (IAS) and a Business Activity Statement (BAS).

Instalment Activity Statement (IAS)

Monthly activity statements are due for lodgement and payment on the 21st of the following month.

Business Activity Statement (BAS)

The Business Activity Statement is required to be lodged either monthly or quarterly.

Monthly reporting

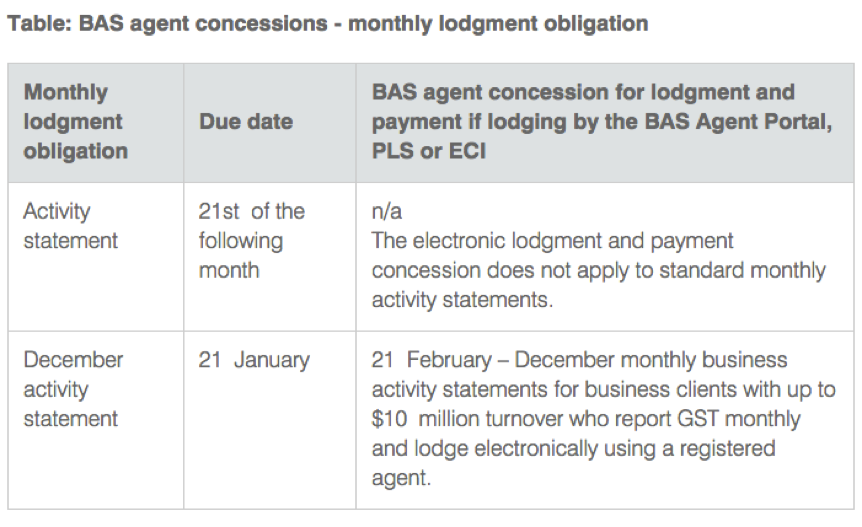

The due date for your monthly BAS is the 21st day of the month following the end of the taxable period. For example, Monthly BAS’s have a due date of the 21st day following the BAS period. Please refer to the below table.

Quarterly reporting

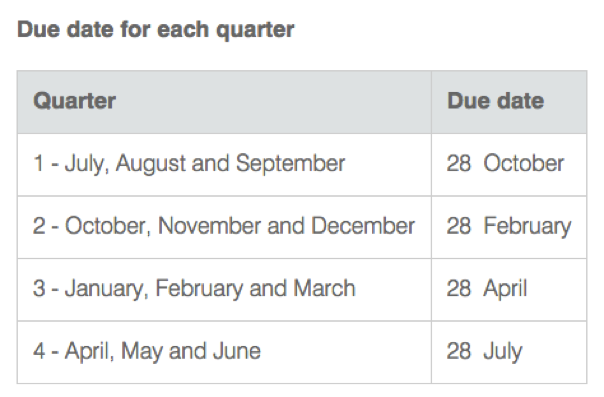

The due date for your quarterly BAS is the 28th day following the respective BAS period. If you are using the services of a BAS or Tax Agent then you will be entitled to an extension due date of the 25th day two months following the respective BAS period.

Please refer to the tables below for more of a guideline:

Alternatively please go to the ATO website for more information on due dates for bas and bas lodgement.